Walkthrough - Sell the goods

In This Topic

Important

Each business process depends on the previous one as we will reuse the data that we create or modify in each example. Be sure to execute all steps in the correct order.

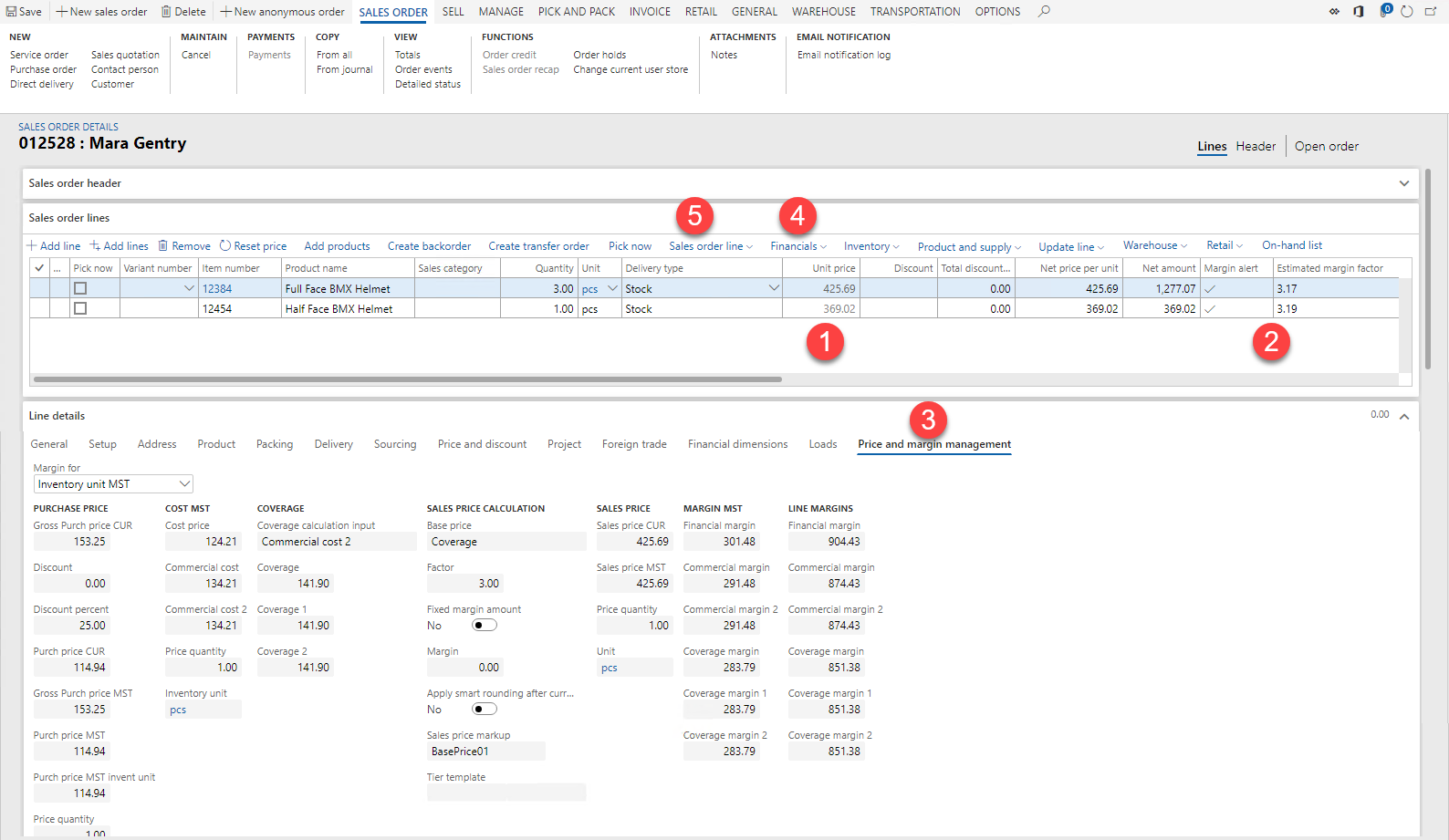

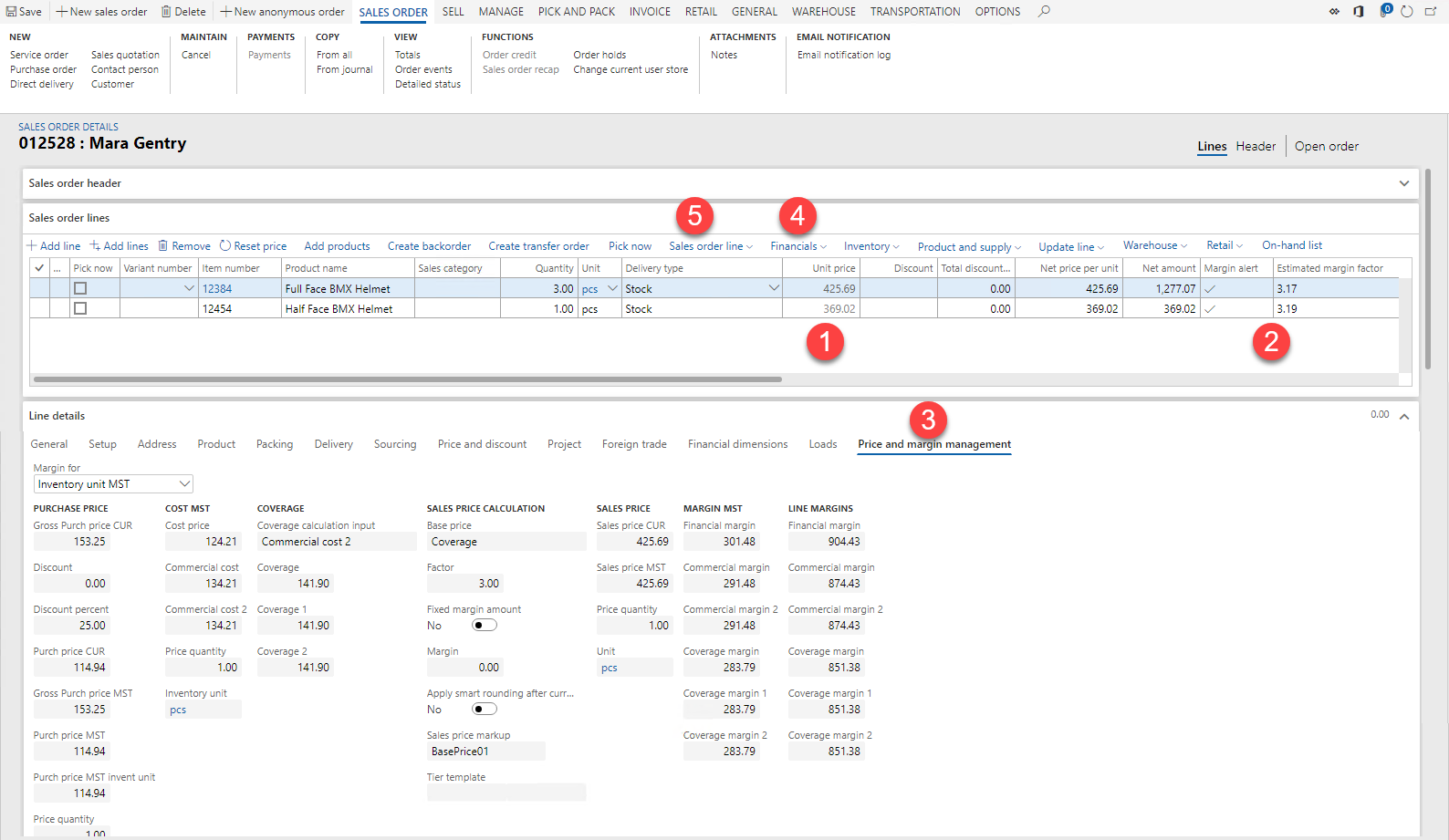

Create sales order

- Create a sales order for customer Mara Gentry

- Add item 12384 with sales quantity of 1 to the sales order line, the prices from the price adjustment are applied (1)

- The margin check (2) is executed against the settings of the price margin worker group, in this scenario Coverage margin 2

- Click on Price and Margin management tab to view the cost price information (3)

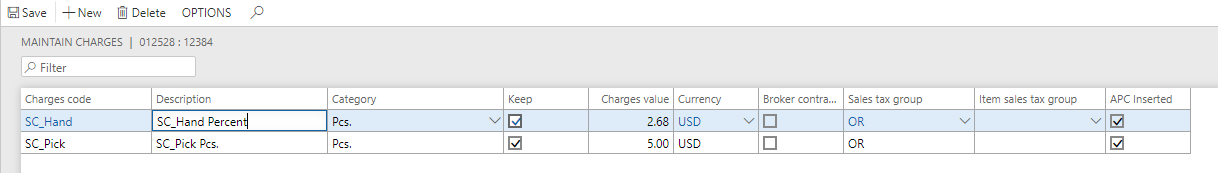

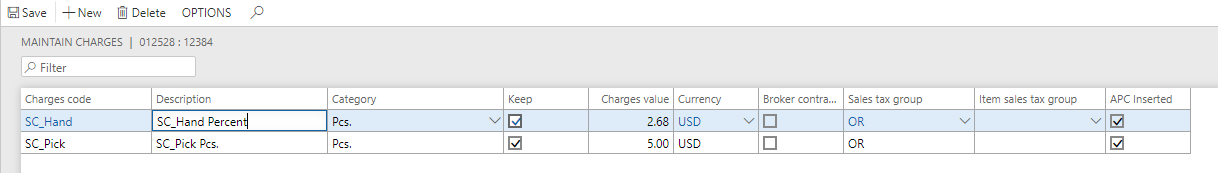

- Click on Financials > Maintain charges to verify that the correct charges are applied for item 12384 (4)

- Click on Sales line > Price details to verify that the correct price adjustment has been applied (5):

Note

The charges are all of the Category pcs. as the value is calculated during the cost to sales price calculation, where as Category percentage would calculate the value base on the the line amount of the current order line and this is wrong. When the invoice is posted it will post this value multiplied by the invoiced quantity.

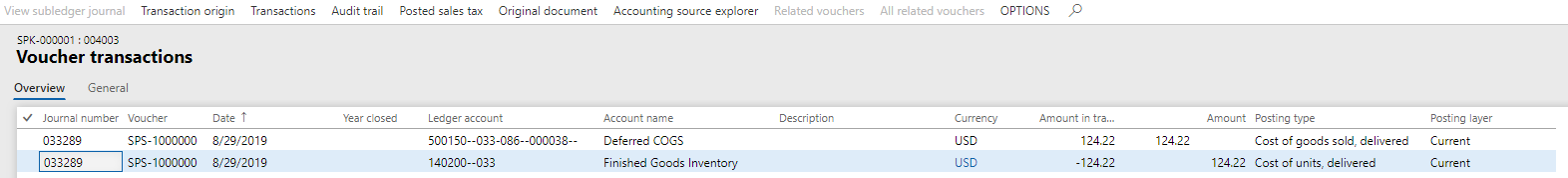

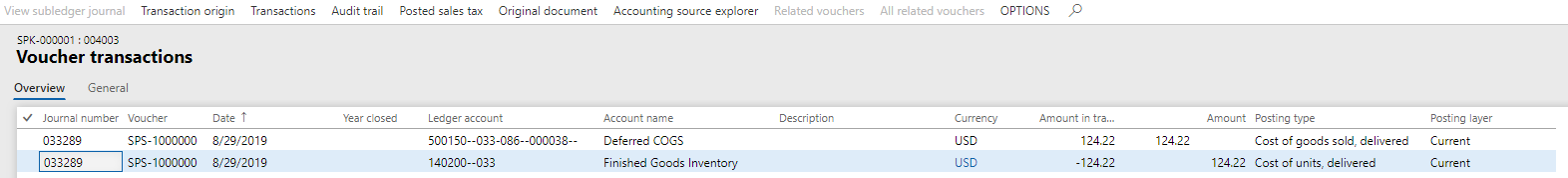

Deliver the goods

- Post the packing slip and check the general ledger postings:

- The coverage values from the charges on the sales order line are not posted yet, this will be done on invoicing.

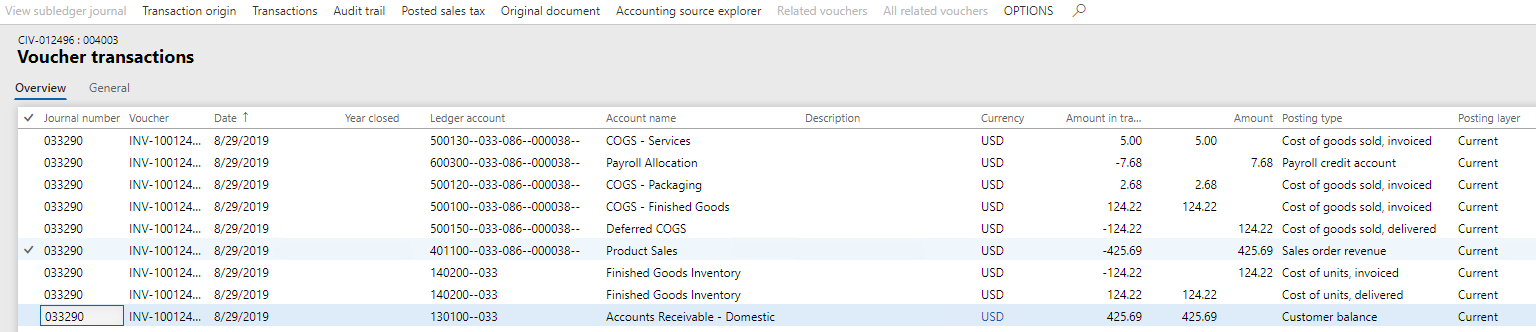

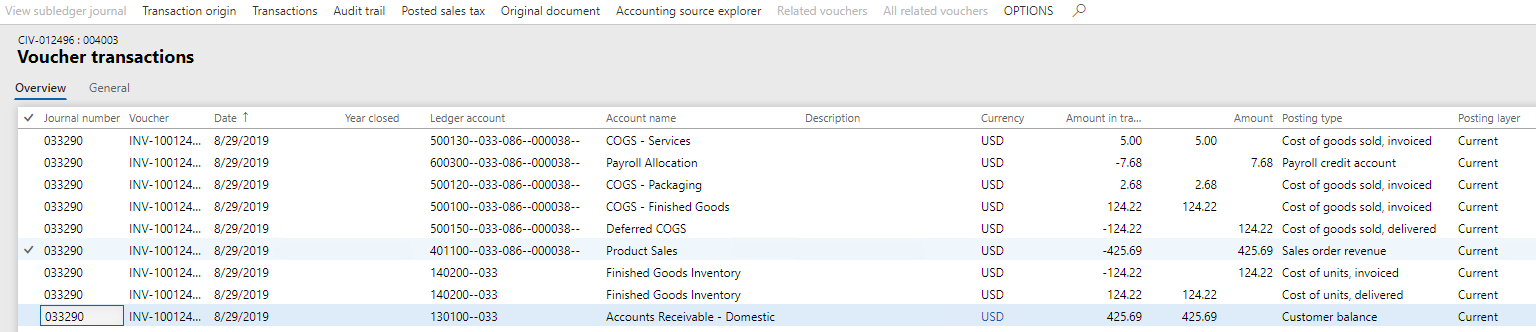

Create sales order invoice

- Post the invoice and check the general ledger postings:

- The coverage values have been posted which means that a part of the profit will be lowered by these postings. The total margin posted to the ledger of this transaction is: 425,69 - 124,22 - 7,68 = 293,79. When you look at the margin fields on the sales order line you see a coverage margin of 283,79. This difference is caused by the fictitious cost surcharge Markup fixed of 10,-- (see Cost to sales calculation breakdown)