General ledger > Journal entries > General journals

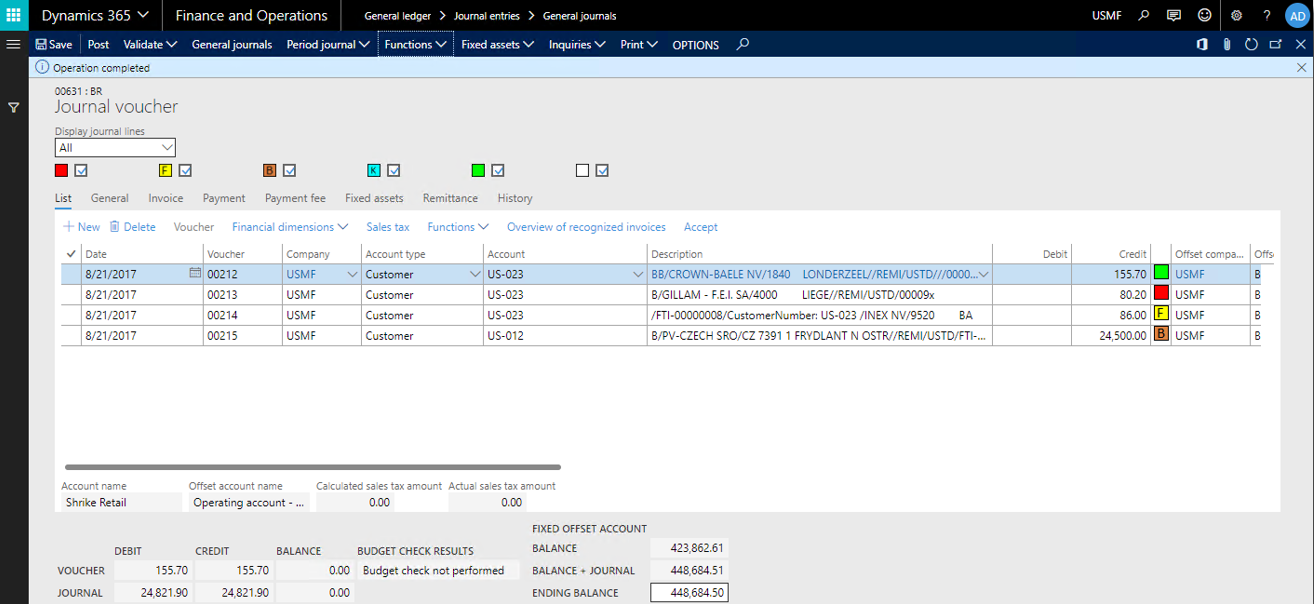

Create a new General Journal and go to the journal lines. A couple of new elements are added to the form:

In Functions > Import account statements (transactions) choose the method of import (MT940 or CAMT053), and select the file to be imported. All the transactions in the file will be imported, as well as the ending balance. On posting, the system will validate if the Balance + Journal value equals the (imported) Ending Balance. This is functionality from the Belgian localization.

During import, Microsoft Dynamics 365 for Finance and Operations tries to determine which customer has paid. By default, this is done by comparing the bank account information in the bank transaction with the bank account information specified for customers and vendors. If available, the IBAN code is used to derive the bank account, using the standard class BankIBANAccountValidator. As an effect, the Postbank accounts will not with a prepix 'P', but with leading zeros. Belgian bank accounts are validated against the 3-7-2 format.

The bank account information is stored on the journal line, and so are Return Reason, and Payment Voucher, if applicable.

Depending on if the amount of the line is positive or negative, Microsoft Dynamics 365 for Finance and Operations will search differently.

For incoming payments, the system will first search within the customers for a match. If it can't find a customer, it will look for a vendor. For outgoing payments, the system will first try to find a vendor. However, if a line contains a 'return' reason, Microsoft Dynamics 365 for Finance and Operations will first search for customers in the case of a debit amount.

The system tries to find a customer or vendor in this order:

If a customer is found, the field Account type is set to Customer, and in the field Account the Customer number is filled.

Sometimes the bank account from which is paid is not of the customer that got the invoice, but of a share service center. In that case consider setting the parameter “Determine account” (Cash and bank management parameters, tab Bank reconciliation) to “Invoice”.

Important

In case of a return transaction, the account will be searched using the voucher number (and not e.g. the bank account).

If the system can not match a transaction to a customer or vendor, the Account type is set to Ledger, and the account number is left blank.

If you receive a single payment, which settles the invoices of 2 different customers (e.g. because you have been paid by a Shared Service Center), clicking this menu-option splits the single journal line into 2 lines, with the correct customer and invoice(s) on each line. It does this based on the invoice information in the payment note, in combination with the amount.

Example:

Customer A is the Shared Service Center

In the system 2 open invoices, for 2 different customers exist:

Customer B has invoice INV160000020 of 804,38

Customer B has invoice INV160000014 of 1040,00

The Shared Service Center pays 1844,38 and informs the company in the payment note that they are paying invoices INV160000020 and INV160000014

On import of the statement the system will find the Shared Service center based on the bank account, but the line will not be marked green when reconciling.

Clicking on the Split Payment the imported row will be split into 2 rows with each row only referencing the invoice belonging to the customer, after which the reconciliation will settle the payment and invoice. By default, the Split functionality is only allowed on lines of type Ledger. But by setting the parameter on the Journal, it can also be used on lines that have already been filled with a customer or vendor.

Obviously, this is an optional step. If Microsoft Dynamics 365 for Finance and Operations cannot split the line, it will not do anything to the line.

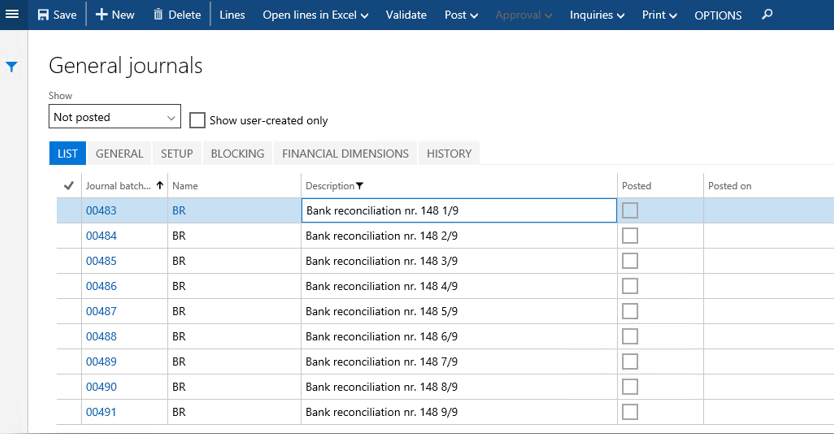

If a company receives many payments each day, it may be too much for a single user to process in a timely fashion. By specifying the maximum number of rows in the Bank Reconciliation parameters, the system can be configured to split larger statements. If the value is 0, splitting is not active.

This Split bank statement at # of lines value can be setup in Cash and bank management parameters.

To ensure correct journals, the system keeps track which journals belong together. In the journal description, the user can see what statement a journals refers to, and how many there are:

As of release 1008.32.640, the Simulate Posting functionality is supported too.

Important